AI-Powered Workforce Management Software

Advancing workforce management and delivering real-world impact with AI and Automation

Step into the future of managing hourly workforces with employee scheduling, time and attendance tracking, labour demand forecasting, absence management and staff retention powered by AI and automation. Gain superior workforce intelligence for optimal data-driven staffing and operational decisions.

Automate workforce management processes for optimal ROI

Our solutions save you time and money and take care of those time-consuming and mundane tasks such as employee scheduling, time and attendance tracking and approval, forecasting sales and labour demand, holiday allocation and absence management while integrating with your business, HR and Payroll systems.

With ShopWorks you always know where to allocate your labour resources for the best ROI.

Promote fairness, improve employee happiness and retention

Because our solutions are AI-Powered, they are completely fair and promote a happy employee environment by eliminating any human biases or unfairness.

Promote employee happiness by always having an accurate payroll, help prevent burnout and comply with labour laws. Track when your colleagues are about to leave and take proactive measures to keep a low churn rate. In turn keep employees engaged and improve performance.

Stay ahead of the competition and improve customer satisfaction

ShopWorks provides deep operational intelligence that empowers effective resource planning and labour optimisation to ensure you get the best ROI.

Through the power of AI, our solutions continuously learn and adjust to the shifts in your demand patterns. This ensures that you are always prepared for unexpected changes in customer demand and can redistribute your resources where needed to avoid loss in revenue and keep you ahead of the competition.

Trusted By Leading Brands

Solutions That Redefine Your Workforce Management

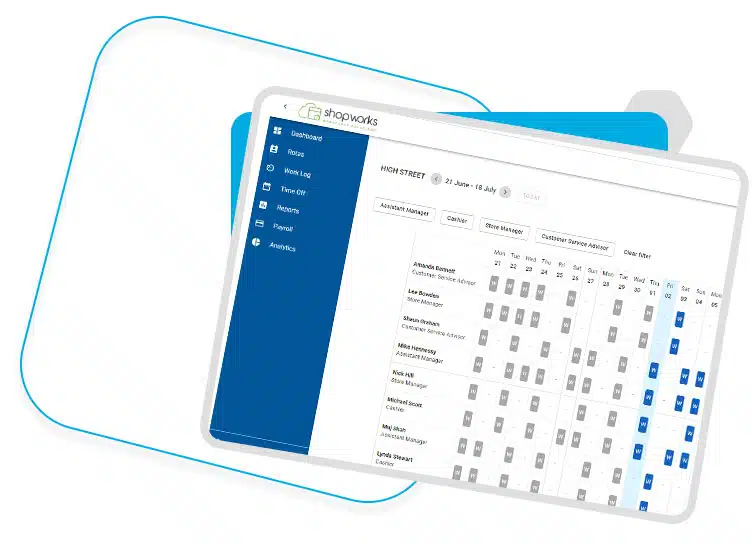

Not just smart rotas, optimum rotas with a click of a button

AI Auto Scheduling

Gone are the days when managers spent hours manually creating drag-and-drop schedules. At the press of a button, create the optimum rota schedules for your entire estate in minutes. Our AI-built rotas are always fair, compliant and on budget.

Your managers can wave goodbye to the many hours spent building rotas each week. Now, they can focus on what truly matters: your people and customers.

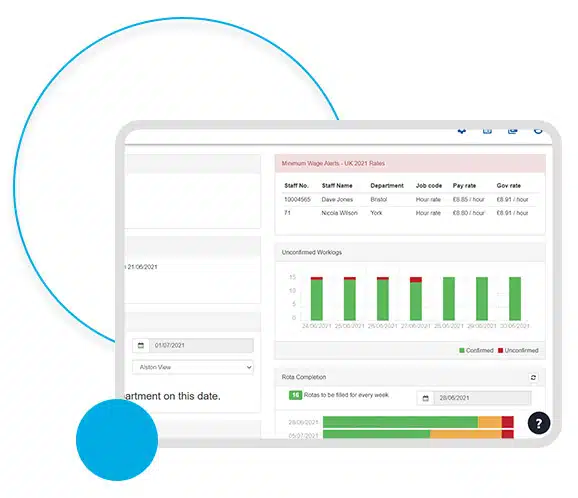

Automated Time and Attendance tracking for hassle-free payday

Time and Attendance

Reduce the admin of your managers and make payday accurate and hassle-free. Let our time and attendance software handle and automate employee time tracking, overtime hours and spending. Eliminate manual timesheet approval thanks to the customisable rules engine and only ever approve exceptions to your pre-defined rules.

Your teams can easily clock in and out through the mobile employee app and check their approved hours to avoid payday errors and costly mistakes.

Make data-driven decisions to always stay one step ahead

Forecasting AI

We have developed the most advanced AI Forecasting tool to help you stay steps ahead of the competition with real-time insights and intelligence into your customer demand patterns. Take control of your workforce and stock expenses, and never face unexpected demand changes.

Identify demand peaks or lows, stay prepared and tackle tough trading periods, all while keeping your business revenue in check and your employees happy.

Align your labour scheduling to your business demand for optimal ROI

Labour Demand AI

Generate the most precise labour demand forecasts, paving the way for your fully optimised rota schedules across all your business locations.

Boost your customer satisfaction by always having the right people in the right place at the right time to meet your demand and optimise your revenue.

Improve your employee satisfaction by eliminating understaffing and help avoid burnout.

Improve employee retention, engagement, happiness and morale

Retention AI

Accurately forecasts if any of your employees are going to leave in the next 30, 60 or 90 days with this unique AI solution.

Gain invaluable workforce intelligence and keep your employees happy by stepping in before it’s too late. Elevate employee satisfaction by showing you genuine care for your team’s happiness and well-being.

In turn, look after your business’s bottom line by saving tens of thousands through reducing staff turnover, cutting recruitment and onboarding costs and retaining organisational knowledge.

Create a more resilient, satisfied, and high-performing workforce.

Automated and fair absence management for better employee satisfaction

Absence Management

Let the system automate and simplify employee absences, ensure smooth operations and happy workforce. Remove admin time for your managers, avoid errors in shift allocation and guarantee that statutory leave is allocated in a fair and efficient way with AI.

Now you can easily maintain optimal staffing levels during your business’s crucial trading periods and remove the requirement for temporary staffing. Ensure you are never understaffed because too many employees are simultaneously taking holidays.

What Our Customers Say

“As a leisure centre , we have a complex workforce that previously required excessive admin for our managers. With the ShopWorks staff scheduling tool, we are able to easily create weekly rotas in advance, ensuring that staff do not exceed their contracted hours."

“The central view has also allowed us to review all of our rostering, ensuring we cut back on over-staffing as well as meeting shortfalls by adding extra staff when demand requires.”

"ShopWorks has centralised and digitised many manual processes for us and much less time is spent on admin.

Employees across the estate are thrilled with the new system and the ability to see their schedules on the go, directly receive important updates and request holidays"

"We needed a rota management system that was flexible, simple to use and cost-effective. As a supplier, they were easy to work with and helped us roll-out quickly. ShopWorks' product and people were a great match for our business."

We Work With A Wide Range Of Industries

Hospitality

Whether you’re in fast food, coffee, restaurant, or hotel management, explore the modules and features our globally recognised customers use to manage their workforce and boost profitability.

Leisure

We help over 4000 leisure venues to deliver 100% Time & Attendance, Time Off and Payroll accuracy, even with multiple contracted staff, to guarantee a happy and motivated workforce.

Retail

Navigating challenging High Street trading times is a breeze with ShopWorks. We are proud to ensure over 5,000 retail sites have the right staff in the right place and at the right time.

Healthcare

In an environment where staff planning is critical, we provide an intuitive and collaborative cloud-based solution that is easy to use and manage.

Warehousing

As eCommerce skyrockets, warehousing demand has hit new heights. Discover how ShopWorks workforce management solutions can keep your business running smoothly and at its best in these dynamic times.

Food Manufacturing

Manufacturers are dealing with unpredictable demand, competition, staffing challenges, and regulations. ShopWorks can predict demand, automate processes, warn about potential staff departures, and ensure compliance for your workforce.

Higher Education

Find out how we can help you improve your efficiencies across all employee groups and all your locations, manage complex labour laws and budgets. Effortlessly managing attendance, absence and leave.

Facility Management

At ShopWorks we can help you deliver Time & Attendance solutions that fit your requirements, 100% accurate payroll, auto scheduling, forecasting and much more.

See Our Workforce Management Software in Action

Get in touch to book a demo and see how our solutions can help your business

FAQs

What is the primary purpose of workforce management software?

Workforce management software is a tool designed to ensure your staff are in the right place at the right time so that you can deliver the maximum return on your investment in staff. It streamlines tasks such as employee scheduling, time and attendance tracking, and labour resource planning, ultimately leading to improved productivity and operational efficiency.

How can workforce management software benefit my organisation?

Implementing workforce management software offers numerous advantages, including better workforce productivity, reduced labour costs, improved scheduling accuracy, compliance with labour laws and regulations, enhanced employee satisfaction, and overall streamlined operations. Get in touch today to book a demo and see our solution in action.

Is workforce management software suitable for businesses of all sizes?

Yes, workforce management software is versatile and can be adapted to businesses of various sizes. There are different providers that cater to the needs of different size companies. Providers for medium, large and enterprise companies will most probably will not be suitable for small companies and start-ups.

Can workforce management software integrate with other existing HR systems?

Most workforce management software solutions are designed with integration capabilities in mind. They can often be seamlessly integrated with existing HR systems, such as payroll software, HRIS (Human Resource Information System) ensuring a cohesive and efficient flow of data across different platforms.

How user-friendly is workforce management software for HR teams and employees?

Modern workforce management software is designed with user-friendliness in mind. HR teams can easily navigate intuitive interfaces to manage schedules, monitor attendance, and generate reports. Employees can access self-service portals to view their schedules, request time off, and check their work hours, promoting transparency and reducing administrative burdens on HR personnel.

Latest from the blog

How Workforce Management Can Help Solve Your Labour Shortages?

The aftermath of the COVID-19 pandemic brought about myriad challenges for businesses, with labour shortages being a prominent concern. Could the solution to this problem be found within the realm of workforce management?

A Guide To Workforce Management Automation

Over the past ten years, many companies have introduced cloud-based Software as a Service tools to manage processes within their organisations. However, we often hear complaints about the workload and admin required to operate...

How AI Can Predict Employee Resignation Using Workforce Management Data?

In today’s dynamic business environment, maintaining a stable workforce is a major challenge for organisations. Traditional methods like surveys, personal interactions, and performance reviews often fail to provide accurate insights, especially in large organizations...